Variable interest rate home loans are the most common of all mortgages. The interest rate is loosely based on the RBA cash rate plus a margin of around 3 percent, however most lenders then offer discounts which will bring this margin back to between 2 and 2.50 percent. The RBA have a monthly meeting to decide on movements to the cash rate and generally these movements are passed on, to some extent by all lenders. Although it is wise to beware of any lender who advertised an interest rate well below the rest of the market as they may simply be deliberately slow passing on a rate increase and so appear for a short period to be very competitive.

Don’t get carried away with lenders discount claims eg: 0.70 percent discount sounds great however that depends on what their standard variable rate is. Unlike a few years when most lenders had very similar standard variable rates, today this can vary by 0.50 percent and so you have to compare based on the actual ‘bottom line’ interest rate being offered.

Another important point to consider is that many lenders tie their interest rate discounts to home loan packages which offer platinum credit cards and other enticements. These are often call “professional packages” and can be very good value for borrowers with a property portfolio, however they usually represent poor value for a borrower with one property. For example on a $250,000 mortgage a $395 annual package fee adds 0.15 percent to the effective interest rate, this would mean the 0.70 percent interest rate discount is really only 0.55 percent.

This depends entirely on what is happening in the market. During a credit crunch or a boom interest rates can rise very rapidly. The RBA meet every month and most lenders will mirror their movements in the Monthly Cash Rate. Increases of 0.25% or even 0.50% can happen monthly, but usually it takes around 6 months for the rate to increase 1.00 %.

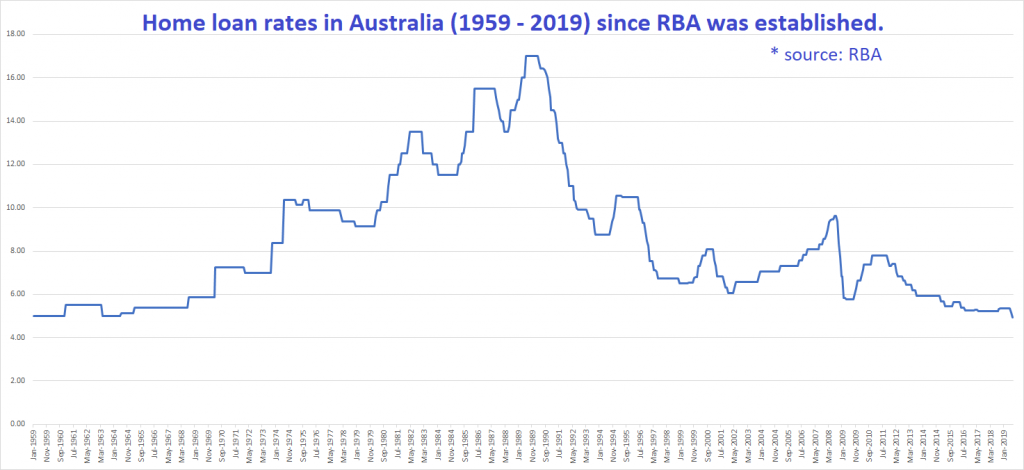

Current interest rates ( June 202) are at historical lows and there is very little capacity for them to fall further.

Before the GFC in 2008 variable rates averaged around 7.0%. Immediately after the GFC there was a credit crunch and rates shot up to 8.50% but then as the economy contracted rates came back down and have been below 5.0% for the last 5 years.